Get This Report about Hsmb Advisory Llc

Get This Report about Hsmb Advisory Llc

Blog Article

The Best Strategy To Use For Hsmb Advisory Llc

Table of ContentsThe 7-Second Trick For Hsmb Advisory LlcHow Hsmb Advisory Llc can Save You Time, Stress, and Money.The Of Hsmb Advisory LlcAll about Hsmb Advisory LlcHsmb Advisory Llc Can Be Fun For AnyoneHsmb Advisory Llc - Truths

Ford says to stay away from "cash money worth or long-term" life insurance coverage, which is even more of an investment than an insurance policy. "Those are very made complex, come with high payments, and 9 out of 10 individuals don't need them. They're oversold because insurance coverage representatives make the biggest commissions on these," he states.

Handicap insurance can be costly. And for those who decide for long-term care insurance policy, this policy might make impairment insurance coverage unnecessary. Learn more concerning lasting care insurance and whether it's appropriate for you in the next section. Lasting treatment insurance can aid spend for costs related to long-lasting care as we age.

The Only Guide for Hsmb Advisory Llc

If you have a chronic health and wellness problem, this kind of insurance policy can end up being critical (Insurance Advisors). Nonetheless, do not allow it emphasize you or your savings account early in lifeit's generally best to take out a plan in your 50s or 60s with the expectancy that you will not be using it up until your 70s or later.

If you're a small-business proprietor, think about safeguarding your livelihood by buying business insurance. In the occasion of a disaster-related closure or duration of restoring, business insurance policy can cover your earnings loss. Consider if a substantial weather condition occasion affected your store or production facilityhow would that influence your income?

Plus, using insurance policy can in some cases cost even more than it saves in the lengthy run. If you get a chip in your windshield, you may take into consideration covering the repair service expense with your emergency financial savings instead of your auto insurance coverage. Health Insurance.

An Unbiased View of Hsmb Advisory Llc

Share these suggestions to protect liked ones from being both underinsured and overinsuredand speak with a relied on expert when required. (https://married-cornet-205.notion.site/Unlocking-the-Secrets-of-Health-Insurance-in-St-Petersburg-FL-9ff5f200db674335b875b1f380ea008f?pvs=4)

Insurance coverage that is purchased by a specific for single-person coverage or protection of a family. The private pays the premium, in contrast to employer-based medical insurance where the company typically pays a share of the costs. People may look for and purchase insurance coverage from any plans offered in the person's geographic region.

Individuals and family members might certify for monetary assistance to lower the cost of insurance policy premiums and out-of-pocket costs, however only when signing up with Link for Health Colorado. If you experience certain changes in your life,, you are eligible for a 60-day duration of time where you can sign up in a private plan, even if it is outside of the yearly open enrollment period of Nov.

15.

It might appear straightforward yet recognizing insurance kinds can additionally be perplexing. Much of this complication comes from the insurance coverage market's ongoing goal to create individualized protection for insurance policy holders. In designing adaptable plans, there are a range to select fromand all of those insurance coverage types can make it challenging to recognize what a certain plan is and does.

Getting The Hsmb Advisory Llc To Work

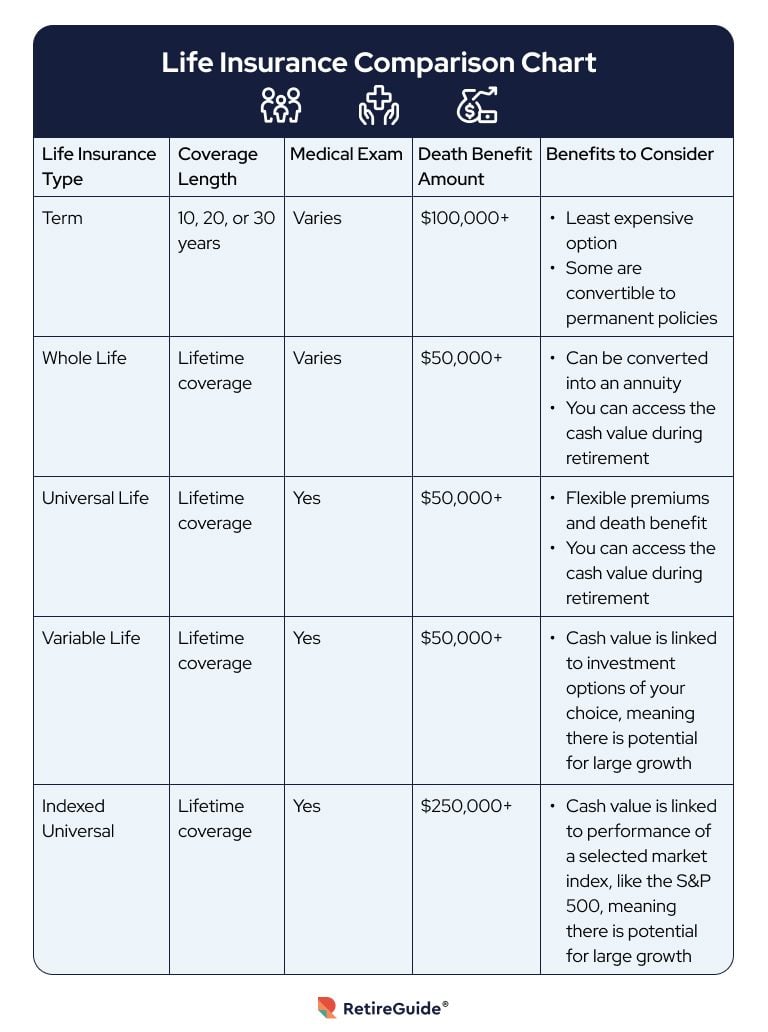

The very best place to begin is to speak about the distinction in between the 2 sorts of standard life insurance coverage: term life insurance policy and permanent life insurance policy. Term life insurance coverage is life insurance coverage that is just energetic temporarily duration. If you pass away during this duration, the individual or people you've named as beneficiaries may get the cash money payout of the policy.

Numerous term life insurance coverage policies allow you convert them to an entire life insurance coverage plan, so you do not lose insurance coverage. Typically, term life insurance coverage policy costs repayments (what you pay monthly or year into your plan) are not secured at the time of purchase, so every 5 or 10 years you own the plan, your premiums could rise.

They additionally often tend to be less expensive total than whole life, unless you purchase an entire life insurance coverage policy when you're young. There are additionally a couple of variants on term life insurance policy. One, called group term life insurance coverage, is usual among insurance options you could have access to with your employer.

Hsmb Advisory Llc Fundamentals Explained

This is commonly done at no charge to the worker, with the capability to purchase extra coverage that's taken out of the staff member's income. Another variation that you could have accessibility to through your company is extra life insurance policy (Insurance Advise). Supplemental life insurance policy can include unexpected death and dismemberment (AD&D) insurance coverage, or funeral insuranceadditional coverage that could assist your family members in case something unforeseen takes place to you.

Long-term life insurance policy merely describes any life insurance policy policy that does not end. There are numerous sorts of permanent life insurancethe most typical types being whole life insurance policy and global life insurance policy. Entire life insurance is specifically what it seems like: life insurance coverage for your whole life that pays out to your beneficiaries when you pass away.

Report this page